Getting Started with Tax Lien Investing

Getting Started with Tax Lien Investing

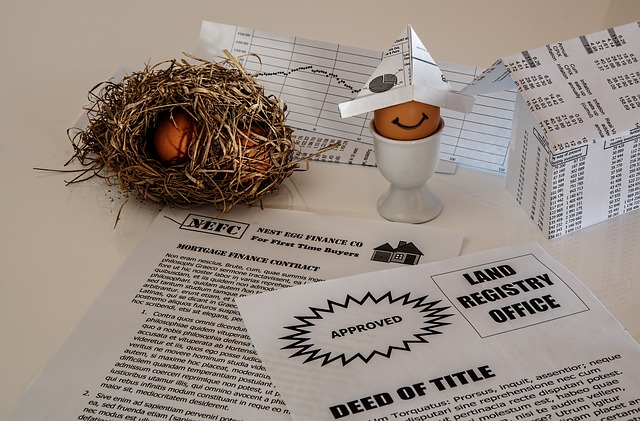

If you have been looking for an investment avenue – that brings both higher returns and the security of a real estate property – tax liens outright surpass that requirement. It’s not like there are no risks involved. But if you know what you are doing – you can gain dividends on the rather smaller chunk of principal – and as high as 18% per annum.

Not impressed yet?

If everything goes right – and the defaulters continue to default their dues – chances are that you can foreclose and get ownership of a house for a fraction of the complete cost. Although, it happens very rarely – only once in 1000 times. There is still a chance.

Let’s see how you can start investing in tax liens without any of the pitfalls or stupid risks –

What are tax liens?

As you know – every landlord and homeowner must pay property taxes. If they do not pay these taxes for an extended period of time – the county governments place a lien on the property – and put it up to be auctioned to investors.

This way – the government gets an immediate solution to cover their losses in time. The homeowners get an easier and swift loan to pay up their capitals – albeit at a higher rate. And you get a chance to invest and make money at such an amazing rate.

The benefits of tax liens –

Along with being a win-win situation for every party involved – tax liens come with amazing perks when it comes to investments. No wonder this investment avenue has been hidden from most people for so many years. Tax liens have been around forever and are a great place to invest with potential high returns as well. Let’s see the amazing perks these liens offer and how you can build a complete cash cow with these little certificates.

- Higher gains with a double digit rate of interest – Tax liens interest rates are set at the time of auctions – while some counties allow the investors to bid based on the rates alone. But you can still plan to secure double digit rates with ease. No fun in bringing the rates down just to win a bid – especially if you won’t make enough money – right?

- Quick returns – Most of the tax liens are due within a period of 3 months to 3 years. So you can expect quick returns over your investment and re-invest to increase your profit.

- Real Estate Guarantee – Since, tax liens are put on the property itself. If the owners continue to default on the payments or do not pay the lien in time – you have the right to foreclose and sell the property – for no extra dues. That’s an amazing guarantee – for no tax liens cost more than 5-10% the cost of a property – ever.

- Easier operation – With most of the counties now conducting and holding the auctions online – investing in tax liens has become easier than ever. You still need to research and evaluate the property – but that tasks can easily be outsourced to the professionals.

- Asset value – Tax liens hold an asset value of themselves – which you can sell or transfer to somebody else – if you need quick money. Again, not all counties allow this, so make sure you do your research beforehand.

- Prospect to Foreclose and Ownership of the property – As mentioned before – if the owners continue to default on their dues – you will have the rights to foreclose the property. Most other blogs out there leave it at this point – but if you continue to read this one – we have the exact and effective ways to make it happen – and easily.

Risks with tax liens and how to mitigate them –

If the profits of tax liens make you feel like these are the best investments ever – think again. These are no different than other investment options out there – at least – not in the sense that every investment that pays off higher yields comes with a risk factor.

But as promised earlier – these risks are easy to manage. All you need is the right information, a thorough plan, and the ability to think long term. So let’s see how you can earn those amazing tax liens returns without taking too much risk or losing all of your money –

- Risk #1 – Required homework and research: All properties with tax liens are not the same. In some case, the cost of a tax lien may as well surpass double the cost of a property.And if you buy a lien on deserted or vacant land that sits in the middle of nowhere – the owners for sure are not going to redeem the lien. And you are destined to lose all your money – for a land that wouldn’t even make pennies.You also need to investigate about the homeowner and guess their financial condition. If they are too deep in losses – it can be both a good and a bad sign. Maybe, they won’t be able to redeem the lien and you’ll have the chance to foreclose the property. However, chances are higher that there will be other liens on the same property. So yeah…

Solution: The best solution is already mentioned within in the headline. You must do your homework and research the property before investing in any liens. If you want to keep the whole business passive, you can always hire a private investigator or a real estate agent to perform the task on your behalf. Just make sure that you choose trustworthy individuals.

- Risk #2 – Expiration date: It would have been amazing if you were allowed to earn that double digit tax until the end of the universe. But – alas! – Tax liens are not an everlasting investment.Most come with an expiration date from three months to three years. And if the owner fails to redeem the liens by that time – the investor may want to foreclose on the property – only to discover that there might be other liens on the very same property.However, that isn’t the end of the world.

Solution: Contrary to the portrayal in most of the blogs and reports online – you still have a chance to get your principal and profits back. Although, the process is not that swift. Keep on reading to find out how you can do it.

- Risk #3 – County rules and regulations: County rules regarding tax liens, rate of interest, and responsibilities of the lien owner aka investor varies a lot from one county to another – and across the whole country. Some of them require you to connect with the homeowners – others allow you the freedom to take care of your own matters. It all can become a bit confusing and scary as well.

Solution: The only solution to this problem is to read the fine print and familiarize yourself with the rules of the very county you plan to invest into. Or you can hire an attorney or lawyer or real estate agent who can explain to you the rules and regulations in an easy to understand language.Although, reading the rules and regulations on your own is highly recommended and ideal.

- Risk #4 – Auctions and the rate of interest: Tax liens are not sold but auctioned off – and the winner is the one who bids the lowest interest rate. The more people that are interested in a property, the lower the rate of interest becomes. Most will work to bring it down.Even worse – big players like banks and hedge funds are getting more and more interested in tax liens. They outbid most of the individual investors with ease and bring down the possible returns even further down.

Solution: First off – let’s be aware that introduction of banks and hedge funds has become the reason why many investors have given up on tax liens altogether. But that doesn’t mean you have to do the same.

The easiest way to get your hands on amazing and worthy tax liens is with a simple two-step process – 1). Bid on more and multiple listings altogether and 2). Never bid a rate of interest that will not yield enough for your finances.

- Risk #5 – Added responsibilities of the lien owners: Some counties do not leave the tax lien investors alone. They have detailed and extended sets of rules stating when and how many times the investor is required to send a notice to the homeowner. A failure to do so may lead to an invalidation of your tax lien certificate.This obviously puts investors in a tough situation – especially those planning to build a passive income stream or those who plan to invest from across the states. However, the solution is easier than the problem itself.

Solution: The easiest solution for this problem is to outsource this task. You can hire an attorney or a manager to inform and visit the property on your behalf. That way – you will meet all of the requirements of the county with the least amount of effort.

- Risk #6 – Other liens on the same property: County governments aren’t the only authority that can place liens on a particular property. For someone who is going through tough times – the chances become higher that they will default on other payments as well – urging them to put additional liens on their property as well.In such a case, even if the person doesn’t redeem a lien in the due time, you won’t be able to foreclose the property, thanks to the other liens. It’s one of the worst nightmares of many lien investors.The interest stops adding up. They don’t get the returns. And even the initial principal ends up locked in a lien that is pretty much useless. Or is it?

Solution: If you were to believe in this portrayal, this is usually where the story might end. However, in reality, you still have options to get your money back and possibly some returns. Keep reading on or scroll down to the “Myth” section below to know how!

- Risk #7 – Homeowner’s behavior: Some homeowners find it a little hard to wrap their minds around the fact that the county has decided to put a lien on their property. They simply cannot fathom the fact that someone has bought the lien already – from whom they now need to redeem it – or else they may lose their property.Most investors have received foul calls, threats, insults, and in some cases, abuse from such owners.

Solution: You know this one by default. Call the necessary authorities and handle the matter professionally. Easy!

The myth – Foreclosing on a property with multiple liens

To recap – if the owners fail to redeem the lien in time – the investor gets the option to foreclose on the property – only to find out that there are other liens on the property and their money is now locked up for an eternity.

At least, that’s exactly what is portrayed by most blogs and other websites.

But let’s get one thing clear here – it’s not the end of the world. You still have options to get your money back as well as gain potential profits. All you need to do is be a little smart and take diligent action.

So let’s see how you can make amends –

- Offer a discount – The cost of liens can become a bit too high to redeem over the complete expiration period. If you offer the owners to redeem the lien at a discounted price and save their home from foreclosing – they might just buy that offer. And you can get out of the bad purchase with somewhat less or no interest. But you won’t lose the principal amount.

- Buy other liens – If you have done the necessary research before buying the property, there should be no way that the total cost of all the liens will amount to anything close to the total value of the property. So let’s say if a property has multiple liens – with all of them amounting up to a collective 25% of the property’s value – you can buy the other liens and take the title to foreclose on the property.

Now, buying liens from every stakeholder – for example, the federal government – won’t be that easy. The good news is – you don’t need their permission to buy it. Just pay it off and foreclose on the property. - Sell the lien – If you do not have enough funds to buy all of the liens, you can choose to sell the lien under your possession. Now, not all counties allow such a sell. But you can still join forces with other investors and foreclose on the property. Remember – they too want their money and profits – so it’s only a matter of time.

So there you have it – the three – although a bit tough but easy – steps to help you get rid of the multiple liens dilemma.

Obviously, it’s assumed that you have done prior research before investing in a particular lien. If the collective value of all the liens surpasses the total value of the property in question – none of the methods described above will work.

So you must be extremely picky when it comes to bidding on a lien.

How to invest in tax liens?

As you are well aware of the many benefits and risks involved with tax liens – let’s see how you can start investing in tax liens in the most secure ways possible. Ready for the baby steps?

- Step I – Research the county: Contact the authorities, websites, books, and organization to understand the laws and regulations concerning tax liens in the county that you plan to invest in. Most of them have setup the websites already and conduct their auctions online – that’s still not the case for all of them. Also, you will want to get familiar with the different county rules and regulations required on your part as an investor (or lien holder) – as well as with the rights that you get when acquiring a tax lien.

- Step II – Research and investigate the properties: Once you have understood the process, get the list of properties that have liens up for the auction. Find the ones that interest you the most, then run a thorough investigation of both the property and the owner. Your aim should be to understand their financial situation as well as to find other dues they may have pending and the current condition of the house itself. Feel free to hire an independent investigator or real estate agent at this level.

- Step III – Place the bids: Once you have selected the properties, go ahead and place worthy but varying bids on each and every one of them. There are many investors trying to get their hands on the same liens. So the chances are far from feasible for you to get all of them. The varying bids will allow you to play at multiple levels – making it easier to close at least a few of them.

- Step IV – Invest and Outsource: Once you have won a bid, go ahead and buy the lien in question. You may want to hire an attorney or real estate agent to take care of all the due process (like – sending notices, etc.) or do them yourself. It depends a lot on your location, daily routine, and how much of your personal time you want to invest in lien trading. In short – it can become either an active or passive business model – based on your preferences.

Final words: It should be obvious – lien trading is not a fool’s game. Read up and research and do not invest a penny unless you’re 100% sure of what you are getting into. With that said – tax liens are still a great way to earn a double digit rate of return.